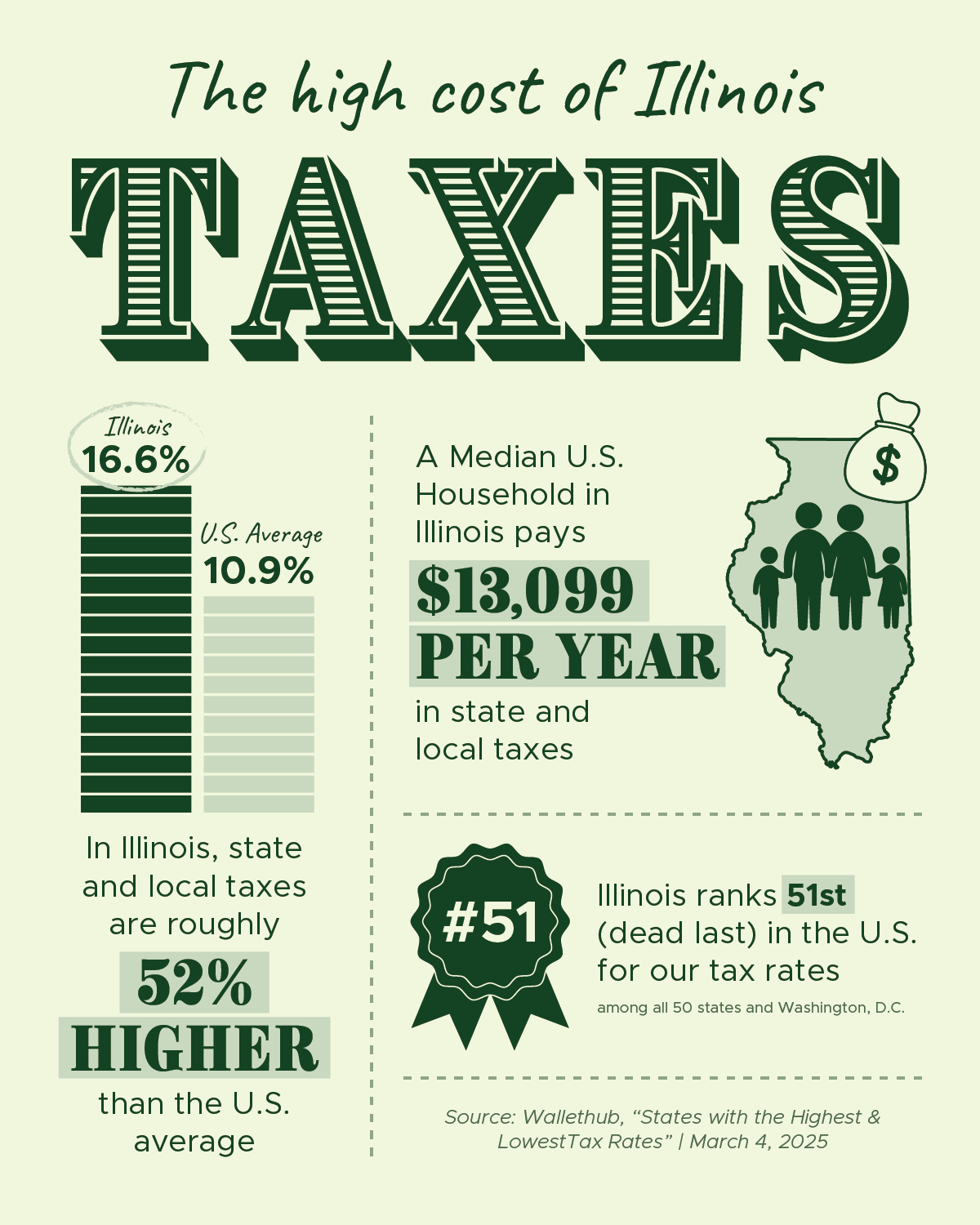

Illinois families are feeling the strain of excessive taxes, and the numbers don’t lie. According to a recent WalletHub study, Illinois ranks 51st—dead last— in the nation for tax rates among all 50 states and Washington, D.C.

💰 Illinois’ state and local tax rate is 16.6%, far above the U.S. average of 10.9%. That’s 52% higher than what the average American household pays.

💰 The median U.S. household in Illinois pays $13,099 per year in state and local taxes—money that could be used for childcare, groceries, or saving for the future.

Illinois families deserve relief. We need policies that reduce the tax burden, create economic opportunities, and make our state more affordable. I remain committed to fighting for responsible tax policies that put hardworking families first.

WalletHub, States with the Highest & Lowest Tax Rates | March 4, 2025